About Diego Ratti Architect

I'm an architect and real estate valuetor with ISO 17024 certification. My clients are mainly banks, r.e. invest., construction comp., etc.

From speculation to Yield Management

Today is no longer considered a low risk practice to invest in the property industry. The speculative bubble, which in the last decade has distorted in a significant way the normal cycle routine of the economic phases, has shown how the risk profile has been too often underestimated, or even hidden from operators. The example of the European southern countries is not negligible. The effect on the economic system has been dramatic and surely not to be imitated.

The principle cause of this process is the introduction on the market of a high quantity of bank’s capital, available to all investors, qualified or not, to invest in high risk profile real estate developments in total absence, or so, of equity. In this speculation optic, if the process was successful the debit passed from the building contractor to the consumer, with great profit of the entrepreneur and high risk for the bank, wile if the process was to fail, the problem and his costs remained to the principal financer partner, the bank.

This bad habit, which I no longer want to dwell on, compels the new generations of building contractors to turn page and face the investments in a more scientific and systematic, objectively analyzing risk, and comparing it with other opportunity.

In now a day situation property trade does no longer looks attractive for investors. The expected yields are too low, more often lower then the capital market and with an high risk profile.

The idea we submit here in the current new real estate projects is the one to consider the building not the aim of the investment (to be sold or rent) but as an equipment case of a more complex entrepreneur activity.

The building is considered as a container of varies activities, which satisfy not only the residential needs but also several services connected with it.

The consumer will choose the type of building that more compliances his needs, in terms of costs and efficiency. The existing building, all over the world, are too often created for a generic market were the only or principal purpose is offer a place call home or an office headquarter without taking in right consideration the complexity of service needed, generally disconnected from the context and empowered by the public.

The true challenge of the new real estate market is exactly the one that will generate buildings or neighbourhoods with high level of integration between home facilities and correlated services, were the contractors can in part avoid the risks of the investments with the incomes coming from this residential service and/or with the earnings coming from electrical production of sustainable energies.

This is a new way, surely more complex, of draw up a investment project, not only buildings but also services for users and consumers, before scheduling a project at urban and/or building scale.

Eventual looses or squaring of the financial statement of the rental activity, could be compensated from incomes created with facilities hosted in the building/property itself, from the improvement of the efficiencies and from profits coming from building activity.

A concrete example of this type of activity is found in the specialized buildings. Take, for example, the case of a building for young people, maybe within the city centre and well connected by public transports, where the main need is the accommodation and where the necessities of the user are also the cleaning services, catering service, laundry services, of access to internet, of lounge and meeting , surveillance and more. All this, obviously without forget the investor/owner, that on the other hand need low running costs of management, therefore high energy efficiency buildings, with low costs of maintenance and well scheduled, with a strong attention to the production of sustainable energies.

Now the user will look for and will choose the building that, within the same rent /cost, will offer better services, better environment were to live, without renounce to the comforts that life stile demands.

This type of operations, are the most difficult to study from an economic point of view and they require a multidisciplinary approach acting on different scales, from town to neighbour, from neighbour to the building, to the accommodation, to the building and technologic detail. All has to be included in a developing project of complex transformation which involves investor, public administration and citizens.

A real estate project with these characteristics, well supported by verifiable and comparable economics evaluations, could met the banks’ appeal, which could distribute loan in a better scheduled way, with a better controlled and certain rate “Loan To Value”, so with less risks.

Here is why in the decision process of the financial credit, even banks can better choose were to invest, or better co-invest within well programmed activities and projects.

All these factors can clearly help to stabilize an economic system, avoiding the speculative bobbles, rewarding the work of the wise entrepreneurs which invest in the urban fabric, developing work society and progress.

Diego Ratti Architect

Translation Gaddo Savi Architect

Featured articles and news

Tackle the decline in Welsh electrical apprenticeships

ECA calls on political parties 100 days to the Senedd elections.

Resident engagement as the key to successful retrofits

Retrofit is about people, not just buildings, from early starts to beyond handover.

What they are, how they work and why they are popular in many countries.

Plastic, recycling and its symbol

Student competition winning, M.C.Esher inspired Möbius strip design symbolising continuity within a finite entity.

Do you take the lead in a circular construction economy?

Help us develop and expand this wiki as a resource for academia and industry alike.

Warm Homes Plan Workforce Taskforce

Risks of undermining UK’s energy transition due to lack of electrotechnical industry representation, says ECA.

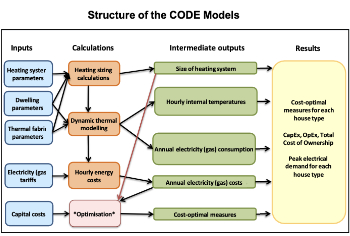

Cost Optimal Domestic Electrification CODE

Modelling retrofits only on costs that directly impact the consumer: upfront cost of equipment, energy costs and maintenance costs.

The Warm Homes Plan details released

What's new and what is not, with industry reactions.

Could AI and VR cause an increase the value of heritage?

The Orange book: 2026 Amendment 4 to BS 7671:2018

ECA welcomes IET and BSI content sign off.

How neural technologies could transform the design future

Enhancing legacy parametric engines, offering novel ways to explore solutions and generate geometry.

Key AI related terms to be aware of

With explanations from the UK government and other bodies.

From QS to further education teacher

Applying real world skills with the next generation.

A guide on how children can use LEGO to mirror real engineering processes.

Data infrastructure for next-generation materials science

Research Data Express to automate data processing and create AI-ready datasets for materials research.

Wired for the Future with ECA; powering skills and progress

ECA South Wales Business Day 2025, a day to remember.

AI for the conservation professional

A level of sophistication previously reserved for science fiction.